Get your home loan wrong and it could cost you thousands in extra tax and interest!

So it’s important to understand your options and choose one that best suits your personal circumstances.

Mortgage offset accounts and redraw facilities are both common home loan features but are not always completely understood by home loan hunters.

The differences are explained below, along with the pros and cons of each option.

Mortgage offset account vs redraw facility: What’s the difference?

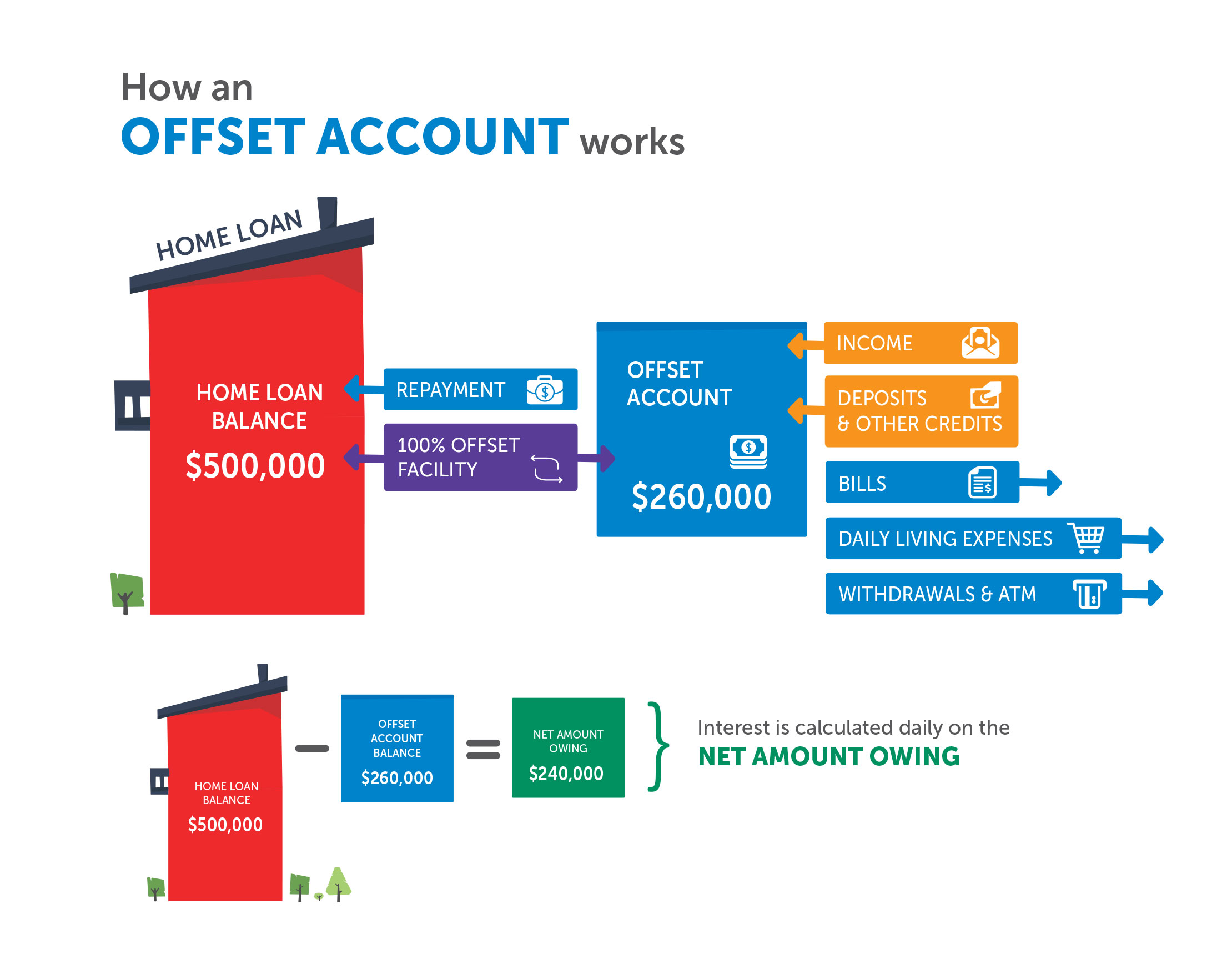

Mortgage offset account

This is essentially an everyday transactional bank account that is linked to your home loan.

Most lenders offer a 100 percent offset facility. This means that every dollar in your offset account will offset (or effectively reduce) your home loan by the same amount. This saves you interest on a daily basis.

A small number of lenders offer a partial offset account, most commonly for fixed rate loans.

In this scenario, if you had a 40 percent offset facility linked to your fixed rate home loan, every dollar in your offset account would offset 40 cents of your home loan.

An offset account generally comes at a cost of between $199 and $395 per annum. It is usually included as part of a “professional package” home loan that also includes a redraw facility.

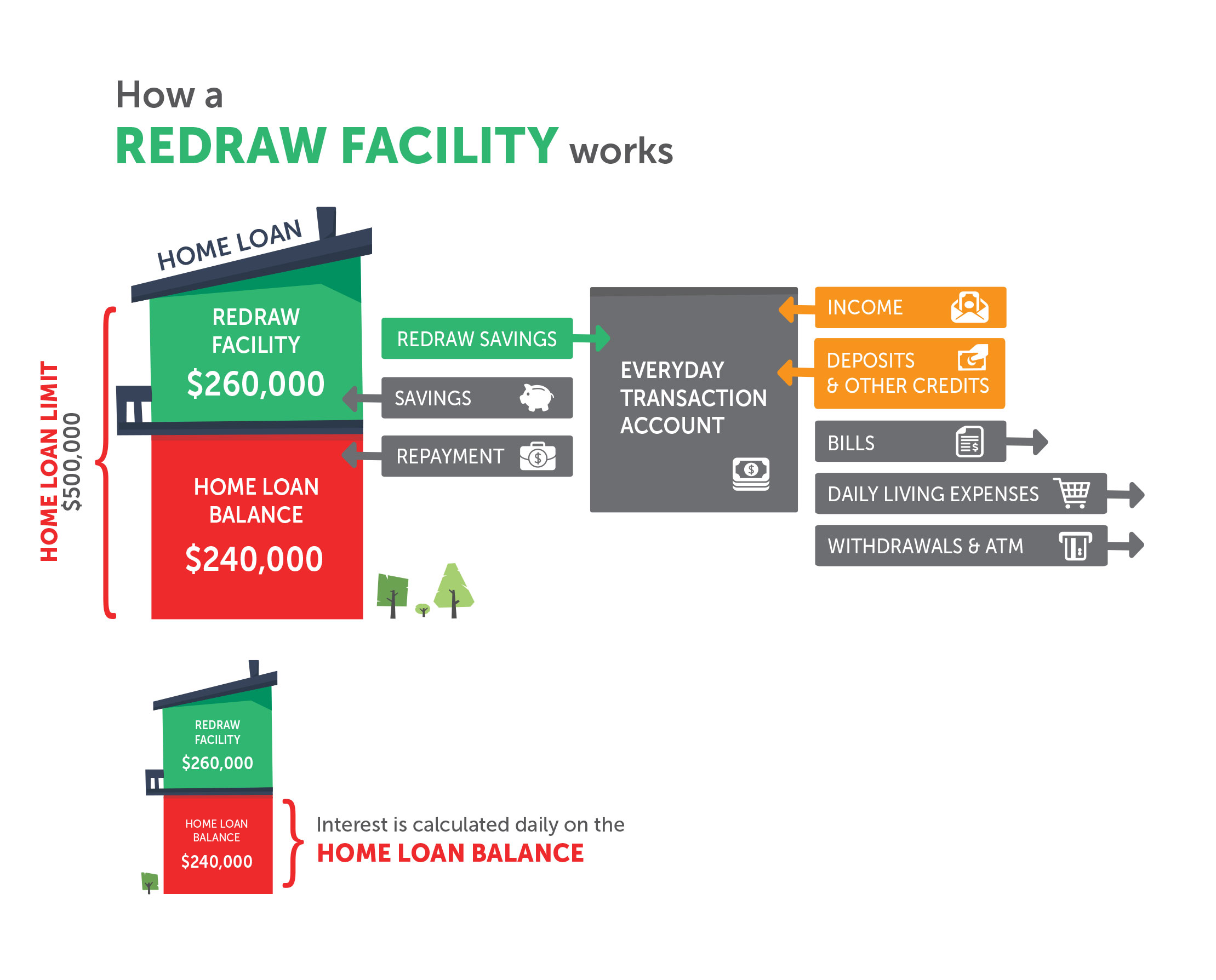

Redraw facility

A redraw facility saves you the same amount of interest as a 100 percent offset account. However, the structure is completely different.

With an offset account, you have two separate-but-linked accounts: a home loan account and an offset account.

With a redraw facility, you lose the offset account and only have the home loan account.

Any extra payments made over and above your regular repayments reduce the home loan balance, thereby saving you interest. Overpayments can then be “redrawn” should you require them.

With a redraw facility, funds are generally not as accessible as with an offset account and a minimum redraw amount and/or redraw fee may be payable.

So which one’s best for you? Mortgage offset account vs redraw

For owner occupiers not looking to turn their home into an investment property, redraw would be sufficient in most cases.

You, the borrower, need to have an idea about how often you’ll be using the redraw facility, so the appropriate lender and product is chosen.

For example, if you’re going to be using the redraw facility multiple times a week, then a fee-free redraw with no minimum redraw amount would be advisable. An offset account would also be suitable in this instance.

If there is any chance that your property will become an investment down the track, an offset account to house your savings is the best choice.

Let’s consider a typical example.

John and Sarah purchase a small unit…

Five years ago, John and Sarah purchased a unit for $625,000 with a loan of $500,000 (80 percent of the purchase price).

Their plan was to use the unit as a stepping stone to a house, keeping the unit as an investment.

The loan was set up with interest-only repayments and an offset account was used to store their savings.

John and Sarah have $260,000 in their offset account and the loan balance for their unit is still $500,000 because the loan was set up with interest-only repayments.

Sarah is pregnant for the second time. With the family set to grow, they’re looking to upgrade to a house for around $1m.

They use $200,000 of their savings for the 20 percent deposit; the rest pays the stamp duty and the furnishings for their new house.

John and Sarah rent out their unit and can now claim a tax deduction on the interest expense for their $500,000 loan.

Please include attribution to www.rightfinancial.com.au when sharing this graphic

What would have happened with no offset account?

Had John and Sarah not used an offset account, how would this have affected their finances?

Say they instead paid down their $500,000 loan by $260,000 by accumulating their savings and then used redraw to purchase their new house.

They would have only been able to claim a tax deduction on the interest part of the remaining $240,000 because the redrawn funds went towards buying a non-tax deductible asset (their family home).

Assuming John and Sarah receive an income of $90,000 and, using an interest rate of 4 percent on their investment loan, by failing to use an offset account, they would pay an extra $4,200 per year in tax for the entire duration of their investment loan!

Please include attribution to www.rightfinancial.com.au when sharing this graphic

This demonstrates why it’s so important to get the right home loan advice from the start.

If you‘d like to discuss your current loan structure with a lending expert, please contact our office here.